Summary:

Vistra Corp. leads the market with a 193% increase in stock price.

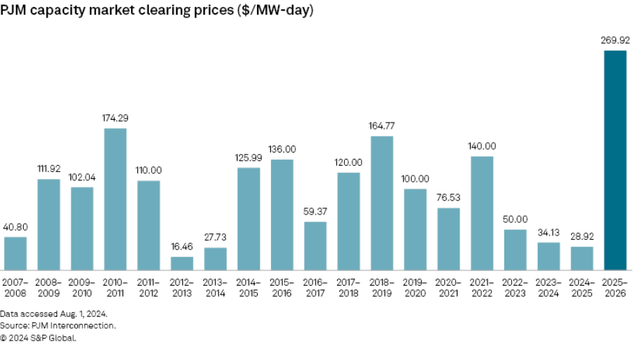

Capacity clearing prices have surged to 10 times the previous year's rates.

Expectations for high prices to persist into the next few years.

Supply chain bottlenecks may delay necessary expansions until 2028.

GE Vernova is positioned for long-term growth as demand for infrastructure rises.

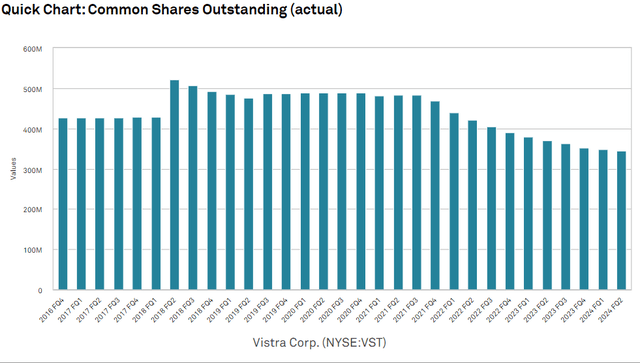

Independent power producers are currently acting like bubble stocks, with Vistra Corp. (NYSE: VST) leading the charge. Here's a closer look at the remarkable growth and the dynamics at play in the energy market.

Unprecedented Stock Growth

- Vistra is up 193% year-to-date.

- Constellation Energy Corporation (CEG) is up 122%.

- Talen Energy Corporation (TLN) has surged by 184%.

- GE Vernova Inc. (GEV) has seen a 92% increase since its listing.

This market phenomenon raises eyebrows, especially as capacity clearing prices for the 2025-2026 year soared to about 10 times the previous year's rates.

Future Price Expectations

The expectation is for high prices to persist into the following years, prompting independent power producers (IPPs) like Vistra to adjust their earnings guidance, forecasting $6B in Adjusted EBITDA for 2026.

Ideal Power Production vs. Broken Equilibrium

In a well-functioning market, supply and demand should balance effectively. Historically, U.S. power generation has managed to maintain this equilibrium. However, recent events have disrupted this balance:

- Decommissioning of old plants has increased.

- Surging demand for electricity has emerged, particularly in regions like Texas (ERCOT).

Supply Chain Challenges

The supply chain is currently strained, with limited production capacity for essential components leading to a bottleneck. For example, it can take until 2028 to get necessary parts, even as demand surges.

Predictions for 2024-2028

- Expect extremely high pricing on capacity auctions.

- Favorable power purchase agreement pricing for producers as demand grows.

- High margins for companies positioned within the supply chain bottleneck.

Conclusion

Vistra and other IPPs are positioned to capitalize on this unique market situation until new supply can alleviate current pressures. The current valuation is attractive, but investors should consider future earnings normalization post-2028.

For a longer-term play, GE Vernova stands to benefit from the ongoing demand for power infrastructure, providing a solid outlook beyond the immediate challenges facing the IPPs.

Comments