Summary:

Transformative entrepreneurs with high IQs and education drive disproportionate productivity gains by hiring R&D workers

Data from Denmark shows a symbiotic relationship between transformative entrepreneurs and R&D workers, boosting economic growth

Transformative firms grow twice as fast in employment and reach seven times initial revenue compared to non-transformative firms

Eliminating financial constraints in education increases R&D workers by 15% and transformative entrepreneurs by 7%, raising growth by 11%

Education subsidies are four times more effective than R&D or startup subsidies in stimulating innovation and growth

Why do some entrepreneurs drive economic growth while others do not? This piece discusses new research that studies entrepreneurs using a comprehensive dataset from Denmark. We examine who becomes an entrepreneur, along with their hiring and business decisions, and find that a distinct minority are "transformative." These individuals, who generate disproportionate productivity gains, tend to have high IQ scores, be well-educated, and hire technical (R&D) workers. The data support the idea of productivity growth being driven by the symbiotic relationship between transformative entrepreneurs and R&D workers. For policymakers, the lesson is that when an economy has more R&D workers and transformative entrepreneurs, they sustain higher long-run productivity growth.

Facts on Entrepreneurs

Our work develops new facts using comprehensive data on individuals and firms from Denmark Statistics. For instance, individuals' IQ test scores come from a military test that is generally taken in very early adulthood. We combine this measure with details of entrepreneurs' education and parental backgrounds and firm performance to connect individuals' backgrounds with their firms.

We identify entrepreneurs as individuals who register as primary founders of firms with at least one employee. Among this group, we distinguish transformative entrepreneurs, those who hire at least one R&D worker, from non-transformative entrepreneurs, who do not employ technical personnel. This classification captures innovation intent rather than performance outcomes. R&D workers are defined as individuals employed in occupations with high patenting intensity, reflecting their direct involvement in innovation-related activities.

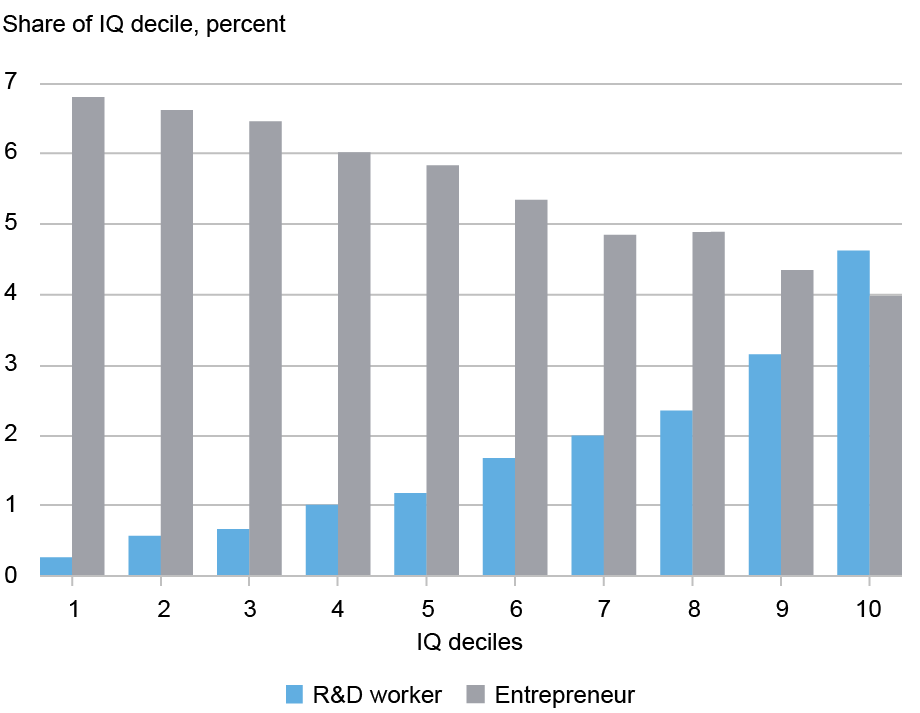

The data reveal striking patterns. The first chart shows how the shares of entrepreneurs and R&D workers vary across IQ deciles. The pattern is reversed across the two groups: individuals with higher IQs are more likely to be R&D workers, but less likely to be entrepreneurs.

Source: Denmark Statistics. Notes: The chart shows the share of all individuals in each IQ decile that are entrepreneurs (gray bars) and R&D workers (blue bars). Definitions available in text and in Akcigit-Alp-Pearce-Prato (2025).

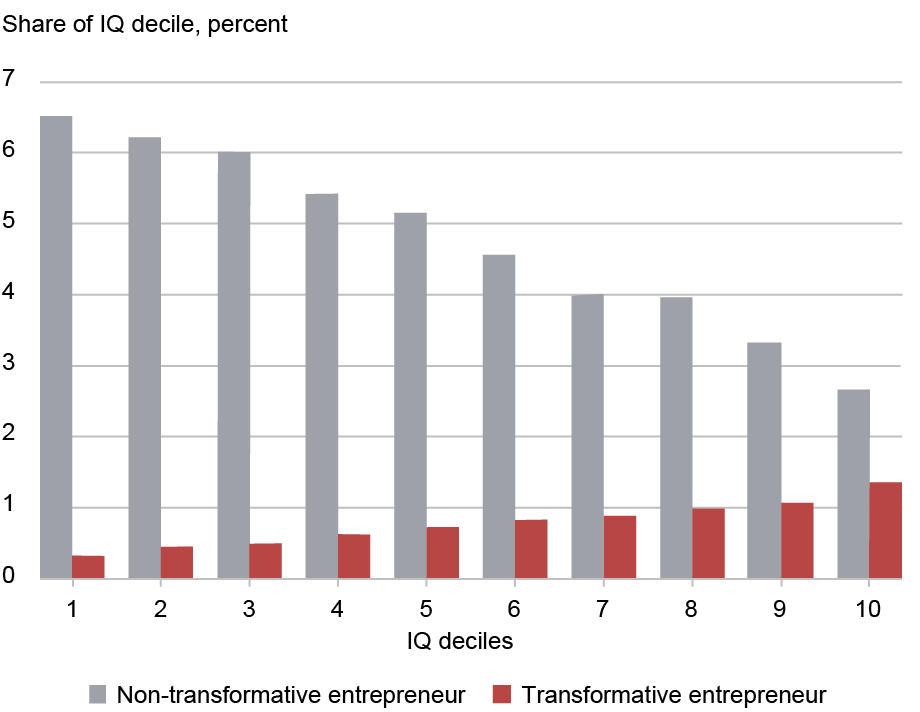

The pattern flips for transformative entrepreneurs, as shown in the next chart: individuals with higher IQs are more likely to be transformative entrepreneurs. These patterns remain when controlling for parental background, education, and age.

Source: Denmark Statistics. Notes: The chart shows the share of all individuals in each IQ decile that are classified as non-transformative entrepreneurs (gray bars) and transformative entrepreneurs (red bars). Definitions available in text and in Akcigit-Alp-Pearce-Prato (2025).

Educational attainment shows similar patterns as IQ: college graduates are less likely to become entrepreneurs overall but are much more likely to found transformative firms once they do. The strongest predictor of entrepreneurship is having a parent who is an entrepreneur. Education is central for transformative entrepreneurship and R&D workers, and is a key building block for an innovative ecosystem.

The Firms of Entrepreneurs

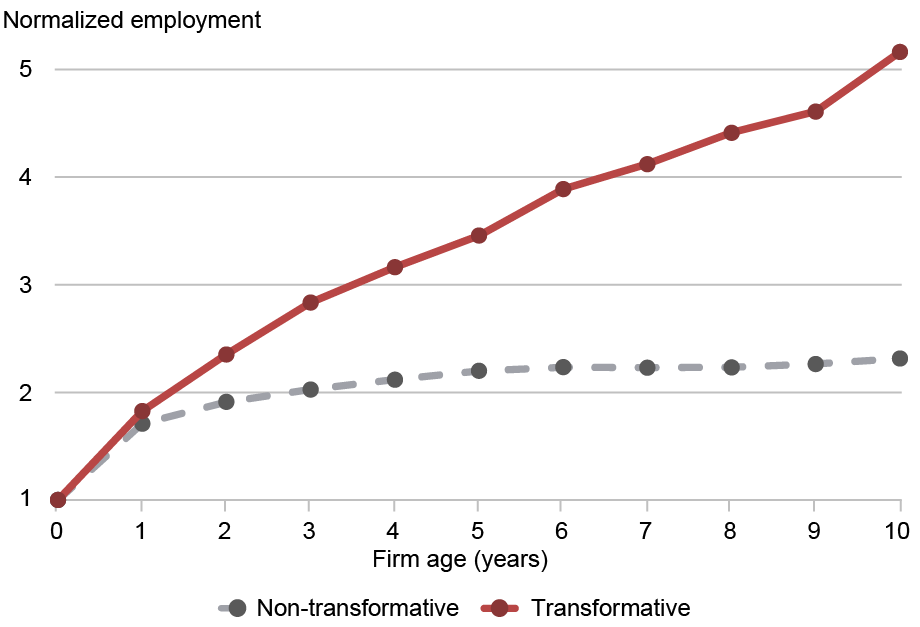

Tracking firm employment over the first decade after a firm is founded reveals substantial performance differences between entrepreneur types. Transformative entrepreneurs start firms that employ approximately twice as many workers as those founded by non-transformative entrepreneurs and maintain significantly higher annual employment growth rates (16 percent versus 8 percent). This can be seen in the next chart.

Source: Denmark Statistics. Note: Average employment by firm age and entrepreneur type, normalized to one at age zero.

Revenue trajectories mirror employment patterns. Transformative firms reach seven times their initial revenue by year ten, while non-transformative firms plateau at 2.5 times initial levels. Exit rates differ modestly between firm types: in their first year, 16 percent of non-transformative firms exit, compared to 12 percent of transformative firms, though both rates converge to around 8–9 percent by year eight.

Industry sorting by IQ also exhibits intuitive patterns. Low-IQ entrepreneurs concentrate in traditional sectors like trade/transport and construction/agriculture, while high-IQ entrepreneurs dominate knowledge-intensive industries, with the knowledge/communication sector representing 50 percent of entrepreneurial activity in the top IQ deciles.

The Macroeconomics of Entrepreneurship

We develop a quantitative model to study the macroeconomic effects of entrepreneurship on innovation and economic growth, incorporating individual differences in ability, family income, and entrepreneurial exposure. In the model, individuals choose between production work and R&D careers initially, then decide later in life whether to become an entrepreneur, consistent with the age profile in the data. In line with the data, educational attainment, necessary for a technical career path, is determined by both ability and family resources. The model replicates key empirical patterns: negative selection into general entrepreneurship with respect to ability, positive selection into transformative entrepreneurship and R&D work with respect to ability, and the observed correlation between firm performance and entrepreneur type.

The model captures the symbiotic relationship between transformative entrepreneurs and R&D workers by linking individual career choices to firm-level innovation decisions. This microeconomic foundation enables us to trace how barriers and choices at the individual level aggregate to economy-wide productivity effects through both supply-side constraints (shaped by the availability of R&D workers) and demand-side limitations (determined by the pool of transformative entrepreneurs hiring technical talent). This framework is necessary to develop a full range of realistic responses to policies and changes in the institutional environment.

We use the model to study the effects of various constraints and policies. Eliminating financial constraints in education access, for example, increases R&D workers' share of the workforce by 15 percent and boosts transformative entrepreneurs' share by 7 percent, with both effects concentrated among high-ability individuals from low-income families. In addition, the pace of economic growth increases by 11 percent.

Supply-side changes alone generate only 60 percent of the total growth effect, with the remaining 40 percent stemming from increased demand for R&D workers by additional transformative entrepreneurs. This illustrates the symbiotic relationship between these entrepreneurs and R&D workers.

Policy-wise, subsidies to technical education outperform R&D and startup subsidies, generating around four times as much initial return at low budgets by unlocking access to innovative careers for talented individuals from disadvantaged backgrounds. These simulations suggest that it is sensible to mix the different subsidies to jointly stimulate the supply and demand sides of the innovation pipeline.

This piece explores the macroeconomics of entrepreneurship using rich microdata. The evidence illustrates that differences between entrepreneur types are stark, and this has substantial implications for aggregate innovation and growth.

The symbiotic relationship between transformative entrepreneurs and technical workers means that policies affecting one group also influence the other. Education subsidies prove most effective because they simultaneously increase both the supply of R&D talent and demand for R&D talent from the pool of innovation-focused entrepreneurs. Policies that develop ecosystems of talent foster connections between the builders of companies and the builders of ideas. This lesson applies broadly to innovation ecosystems: a thriving economy emerges from many interconnected elements working together.

Comments