Summary:

Kevin O'Leary argues that chaos and economic corrections are statistically the best times to start a business, as entrepreneurs can thrive by pivoting through disruption

Despite tariff-induced market chaos, business applications rose 0.5% in August, with retail trade seeing the most gains while other sectors remained flat

AI adoption is boosting productivity, enhancing margins, and reducing costs across all sectors, contributing to record stock market highs

O'Leary advises focusing on policy changes over politics to identify and invest in dislocated opportunities with minimal risk

He warns that H-1B visa fee hikes could disadvantage startups in the global talent race for specialized roles like AI engineers, suggesting exemptions for smaller companies

Shark Tank star Kevin O'Leary acknowledged that President Donald Trump's tariffs are a headache and increase input costs, but said entrepreneurs have not only survived in similar environments but also thrived.

In a wide-ranging interview with Politico on Monday, he said entrepreneurs have endured trade wars, periods of sky-high interest rates, and a real-estate meltdown.

"In fact, the best time to start a business, proven by the statistics, is in chaos," O'Leary added. "Every time the American economy is going through some kind of a correction is a fantastic time to be an entrepreneur and start something. And then you have to figure out how to pivot through it."

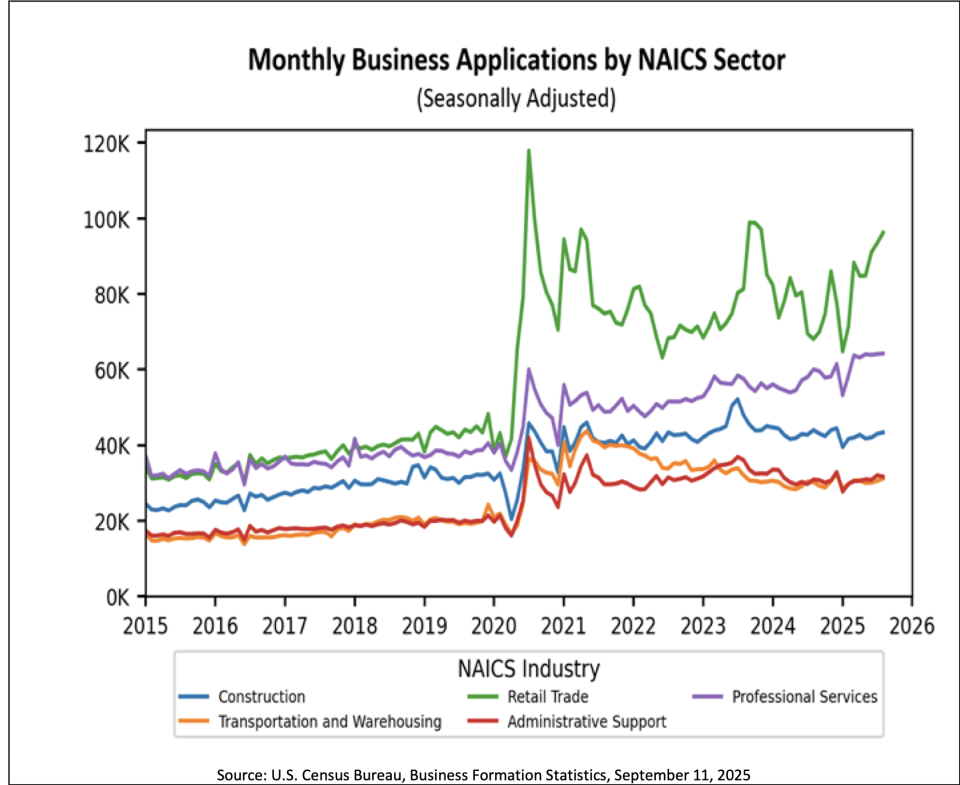

According to the Census Bureau, business formations soared during the pandemic after falling in the immediate aftermath of lockdown and have been volatile since then, with several big spikes and sharp dives.

In August, the number of business applications rose 0.5% from the prior month, continuing an uptrend that began earlier this year despite a brief retreat that coincided with Trump's tariff rollout, which triggered chaos in financial markets as duties headed for the highest levels in nearly a century.

However, most of the recent gains have been concentrated in retail trade, while construction, administrative support, professional services, as well as transportation and warehousing, have been flat.

O'Leary added that the advent of AI has boosted productivity and contributed to the stock market hitting record highs.

"Every single one of my companies uses it today, and it's very productive. It helps enhance margins. It reduces costs in every sector of the economy," he explained.

For example, homebuilders are using AI to help allocate capital expenditures and labor. And while large companies like automakers are getting hit with higher costs, O'Leary said trade deals are getting worked out.

Deals with the European Union, Japan, and South Korea, for example, have lowered auto tariffs to 15% from 25%, while also committing them to hundreds of billions of dollars in U.S. investments.

In such an environment, the key is to look past the politics and focus on the policies "so you can make radical investment decisions at minimal risk," O'Leary argued.

"If you look for the path of least resistance, you want to find big opportunities because of disruption," he explained. "You want to find something that has completely been dislocated and invest in that because of the policy changes."

Meanwhile, O'Leary also cautioned the Trump administration against its deal with Intel, interfering with the Federal Reserve's independence, and the spillover effects of its H-1B visa policy on startups, which will have a harder time paying the proposed $100,000 fee than large companies.

O'Leary pointed out there's highly specialized talent that can't all be filled with domestic workers. And startups that hire AI engineers from abroad, for instance, gain a competitive advantage amid the global talent race.

"I don't think we want to take that away from American companies," he said. "So I would adjust this H-1B mandate for only large corporations at some size where they can afford it."

Comments