Summary:

Palmer Luckey launches Erebor, a neobank for crypto and startups, raising $225M at a $2B valuation

Backed by Peter Thiel's Founders Fund and Joe Lonsdale's 8VC, targeting the innovation economy

Leadership includes tech innovators and banking veterans, blending expertise for a unique offering

Aims to fill the gap left by Silicon Valley Bank, focusing on underserved crypto and startup sectors

Team features co-CEOs with crypto compliance and fintech experience, ensuring a robust regulatory approach

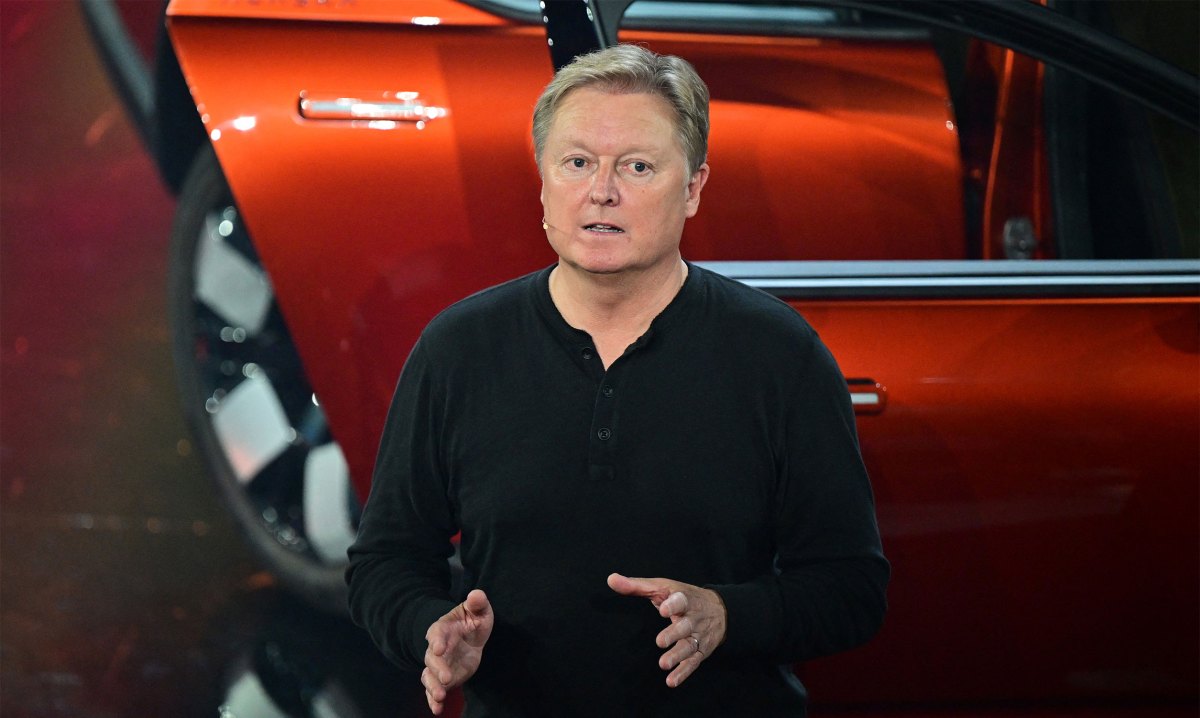

Palmer Luckey, the visionary behind Oculus and Anduril Industries, is venturing into the fintech space with Erebor, a neobank aimed at serving crypto companies and startups. With a $225 million funding round at a $2 billion valuation, backed by heavyweights like Peter Thiel's Founders Fund and Joe Lonsdale's 8VC, Erebor is poised to fill the void left by Silicon Valley Bank.

The Brains Behind Erebor

The leadership team is a blend of tech innovation and traditional banking expertise:

- Palmer Luckey: Founder, known for Oculus and Anduril.

- Trevor Capozza: Cofounder, with a background in asset management.

- Jacob Hirshman & Owen Rapaport: Co-CEOs, bringing experience from crypto compliance and fintech.

- Aaron Pelz: CTO, with a strong software engineering background.

- Michael Hagedorn: President, with decades in banking at Wells Fargo and UMB.

- Ricky Grant: CFO, former head of investor relations at Customers Bank.

- Joshua Rosenberg: Chief Risk Officer, ex-Federal Reserve and NYU Stern professor.

- Vlad Dubinsky: Chief Credit Officer, with experience in commercial lending.

Why Erebor Stands Out

Erebor is not just another neobank. It's designed to cater to the innovation economy, offering services tailored for crypto firms and startups, a niche that's been underserved since the fall of Silicon Valley Bank. With a team that combines tech savvy and banking rigor, Erebor is set to redefine financial services for the digital age.

Comments