Summary:

Ron Zori joins Lerer Hippeau as its first senior venture hire, marking a significant milestone for the firm

Zori’s journey from professional soccer in Israel to venture capital highlights his diverse background and unique path to success

Lerer Hippeau’s $200 million ninth fund targets AI and fintech, sectors where Zori has deep experience

Zori’s operational roles at Knotel and Public give him a unique perspective on scaling startups

The firm aims to expand its reach to Israeli and European startups, with Zori playing a key role in this strategy

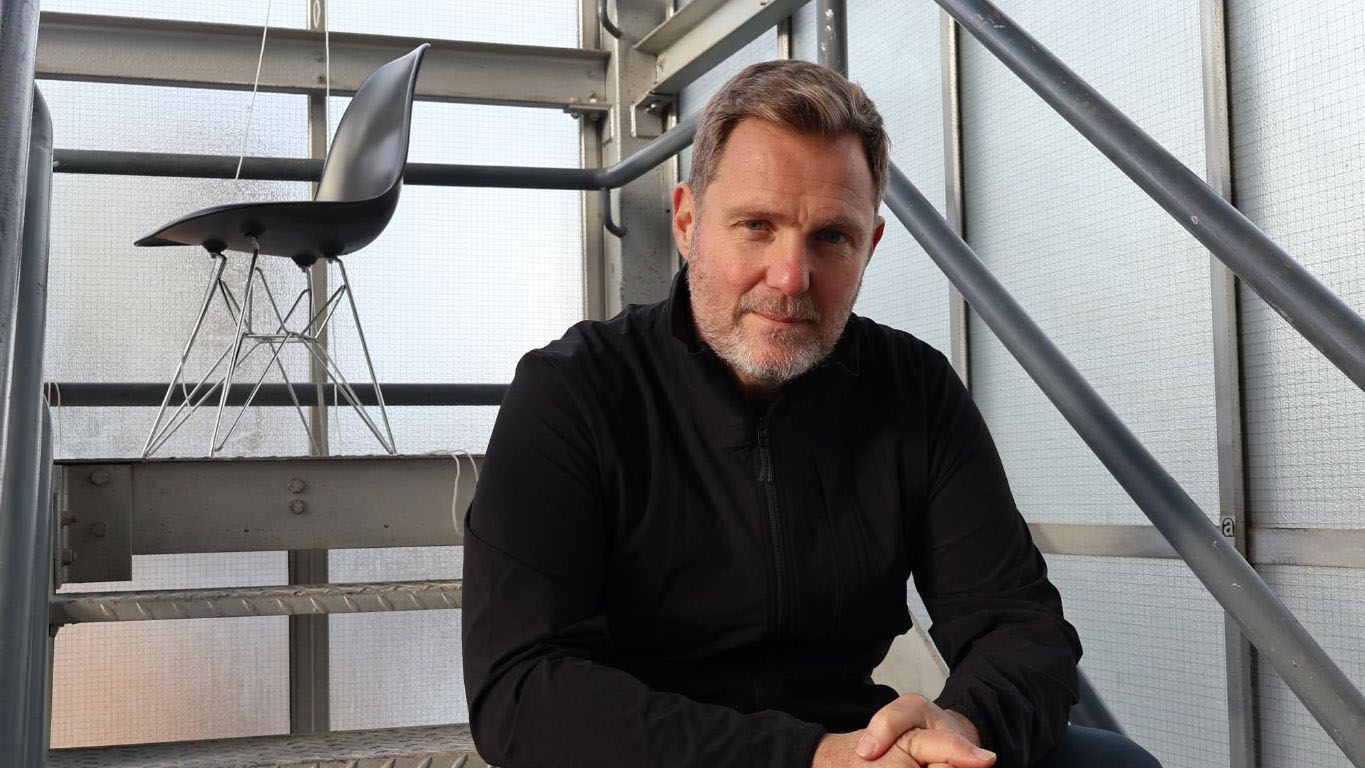

Ron Zori’s venture capital journey began unexpectedly during his freshman year at Columbia University, over coffee at the Mercer Hotel in SoHo. A chance encounter with Lukasz Gadowski, a founder of Delivery Hero, led to an introduction to Edward Shenderovich of Kite Ventures, marking the start of Zori’s venture career. This serendipitous meeting set the stage for a career that would include leadership roles at Knotel and Public, and now, a historic position as the first senior venture hire at Lerer Hippeau.

Ben Lerer, co-founder of Lerer Hippeau, sees Zori’s ability to forge connections as unparalleled. "I’ve never met anybody in my life like that," Lerer remarks, highlighting Zori’s unique talent for networking. Zori’s background is as diverse as his professional journey, having been a professional soccer player in Israel before pivoting to venture capital.

Lerer Hippeau, known for its early investments in Warby Parker and Casper, recently announced its ninth fund, a $200 million vehicle aimed at sectors like AI and fintech. Zori’s hire signifies a strategic move to bolster the firm’s presence in these areas, leveraging his experience in scaling companies from zero to one.

Zori’s tenure at Knotel and Public provided him with firsthand experience of startup growth trajectories, from infancy to unicorn status. His transition to Lerer Hippeau is seen as a natural progression, combining his operational experience with the firm’s investment acumen. "That was the rush," Zori says of Public’s rapid growth, "That’s what I’m here for."

Looking ahead, Zori plans to focus on fintech and consumer sectors, while also expanding Lerer Hippeau’s pipeline to Israeli and European startups. His dual role will involve not only identifying promising ventures but also supporting their expansion into the U.S. market.

Venture Deals Highlights:

- Qlub, a Dubai-based contactless payment solution, raised $30 million.

- Stellaria, a French sustainable nuclear energy company, secured €24 million.

- Paddle, a SaaS billing solutions provider, garnered $25 million.

- Alix, an AI-powered estate settlement platform, closed a $20 million Series A.

- Mango, offering risk infrastructure for construction, raised $3 million in seed funding.

- Dockware, an AI logistics company, secured $2.5 million.

Comments